- Budgeting & Goals: Customizable zero-based budgets with flex or category based budgeting

- Investing: Detailed portfolio & advisor tools

- Unique Features: Link multiple joint and individual accounts for a complete family financial picture

- Bank Sync & Alerts: Syncs with over 13,000 institutions, notifications

- Best For: Couples, advisors, and power users

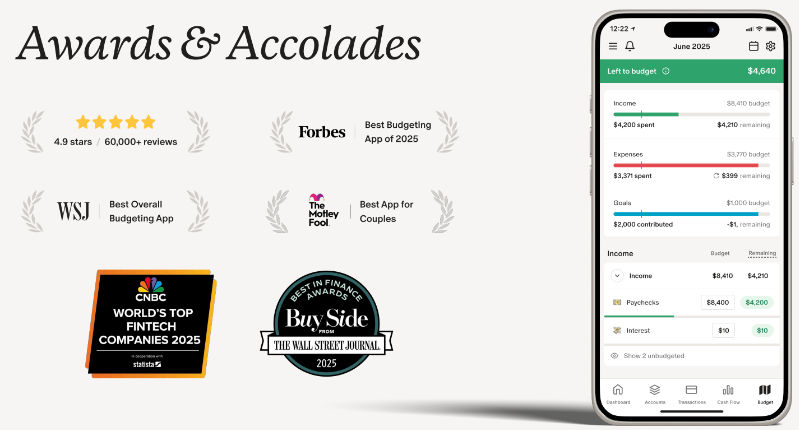

Monarch Review

Overview and Key Considerations Before Choosing Monarch

Monarch is a modern personal finance platform designed for people who want a centralized, highly customizable, and privacy-focused way to manage their money. At its core, Monarch aims to replace fragmented financial tracking tools with a single, cohesive dashboard that brings together budgeting, investments, net worth tracking, and long-term planning. For users evaluating whether Monarch is the right fit, several factors are worth considering before making a purchase.

One of the most important considerations is how hands-on you want to be with your finances. Monarch is built for users who value insight and control rather than automation alone. While it does a great job of pulling in data automatically, its real strength lies in allowing users to categorize, analyze, and customize how financial information is displayed. This makes it especially appealing to individuals and households that enjoy actively engaging with their financial data.

Another factor is privacy. Monarch positions itself as a paid product rather than an ad-supported one, which directly impacts how user data is treated. If avoiding advertisements, sponsored recommendations, and data resale is important to you, Monarch's business model is a significant differentiator. Users should also consider whether collaboration features matter, particularly for couples or partners managing shared finances.

Finally, prospective users should consider the scope of their financial life. Monarch is best suited for those with multiple accounts, investments, and financial goals who want everything visible in one place. Simpler financial situations may not require the platform’s depth, but growing households and professionals often find that Monarch scales well as complexity increases.

Core Features and Financial Management Capabilities

The all-in-one financial dashboard serves as the foundation of Monarch. It provides a single view of accounts, balances, budgets, goals, and investments, allowing users to quickly understand their overall financial health. Instead of jumping between apps or spreadsheets, users can see their complete financial picture in one interface that updates automatically.

Monarch connects with over 13,000 financial institutions, enabling real-time transaction tracking across checking accounts, savings accounts, credit cards, loans, and investment platforms. This broad connectivity ensures that transactions are imported accurately and consistently, reducing the need for manual entry and helping users stay up to date on spending and income.

Accurate balance updates are another key strength. Monarch frequently refreshes account balances so users can trust that what they are seeing reflects their current financial position. This reliability is essential for budgeting, cash flow planning, and monitoring upcoming expenses.

Investment monitoring is integrated directly into the platform, allowing users to track portfolios alongside everyday spending. Monarch shows account balances, asset allocation, and performance over time, helping users understand how investments contribute to overall net worth. This integration is especially helpful for long-term planning, as users can see how saving, spending, and investing work together.

Custom reporting is a standout feature for users who want deeper insights. Monarch allows users to create reports that track spending trends, cash flow, and even tax-deductible expenses. These reports help identify patterns, uncover inefficiencies, and support smarter financial decisions. Over time, these insights can be invaluable for adjusting budgets and planning for future goals.

Partner collaboration is built directly into Monarch, making it easier for couples or households to manage finances together. Both partners can view shared accounts, track progress toward goals, and stay aligned without juggling separate tools. This shared visibility helps reduce misunderstandings and supports better communication around money.

A newer feature offering credit score monitoring and smart alerts expands Monarch's value beyond budgeting. Users can keep an eye on their credit score directly within the platform, while smart alerts notify them of important changes or unusual activity. This proactive approach helps users stay informed and respond quickly to potential issues.

Customization, Privacy, and Competitive Differentiators

One of Monarch's most compelling advantages is its emphasis on full customization. Users can tailor categories, rules, dashboards, and reports to match their personal financial structure. This flexibility allows the platform to adapt to different lifestyles, income patterns, and financial priorities rather than forcing users into rigid templates.

Monarch's no-ads experience sets it apart from many competitors. Because the platform does not rely on advertising revenue, users are not distracted by promotions or nudged toward financial products. This creates a cleaner interface and fosters trust, as the focus remains on helping users understand their finances.

Equally important is Monarch's stance on data privacy. The platform does not sell user data to third parties, which is a major concern for many consumers in the financial app space. Knowing that personal financial data is not being monetized elsewhere provides peace of mind and aligns with Monarch’s subscription-based model.

Smart alerts further enhance the experience by drawing attention to significant changes, such as unusual spending or balance fluctuations. These alerts act as an extra layer of awareness, helping users stay proactive rather than reactive when managing money.

The platform’s ability to grow with users is another differentiator. As financial lives become more complex, Monarch's reporting, collaboration, and customization features remain relevant. This makes it a strong long-term solution rather than a short-term budgeting tool.

Common Questions

Is Monarch suitable for couples? Yes, Monarch is designed with partner collaboration in mind, allowing shared visibility into accounts, budgets, and goals while supporting transparent communication.

How secure is Monarch? Monarch prioritizes security and privacy, using strong encryption and a business model that avoids selling user data to third parties.

Does Monarch work for investments and daily spending? Yes, the platform integrates investment monitoring with everyday transaction tracking, providing a complete view of both short-term and long-term finances.

Conclusion

Monarch is a powerful personal finance platform for users who want clarity, customization, and control over their financial lives. With its all-in-one dashboard, extensive account connectivity, investment tracking, and privacy-first approach, it stands out in a crowded market. For individuals and households seeking a comprehensive, ad-free, and collaborative financial tool, Monarch offers a thoughtful and well-rounded solution.

.png)